| Entry type: Book | Call Number: 3668 | Barcode: 31290036143899 |

-

Author

Barker, D. A. (Dalgairns Arundel)

-

Publication Date

1913

-

Place of Publication

Cambridge

-

Book-plate

No

-

Edition

First

-

Number of Pages

141

-

Publication Info

hardcover

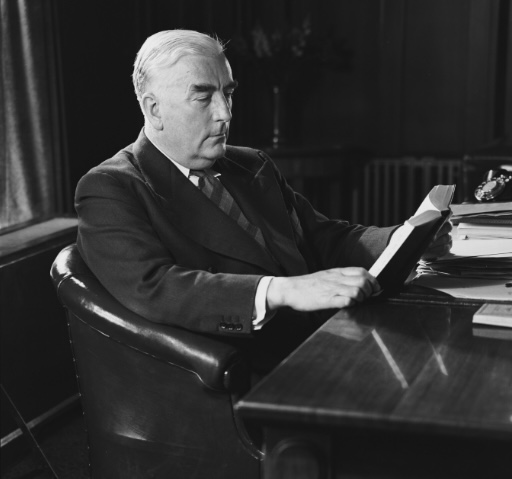

Copy specific notes

Bookplate inserted; bookseller stamp for A. H. Spencer, Melbourne inside cover; signed in pencil on front endpaper: “Robert G. Menzies”. Some highlights with pencil in margin / underlining of text throughout, including: “[It will be convenient at this point to describe a most important monetary truth which is aptly illustrated by the example of primitive currencies.] This is the so-called Gresham’s law – that bad money drives out good money.” [p. 14]; “It is by limitation of issues, and by limitation of issues only, that a coin, without any special privileges, can be kept in circulation at a rate higher than of its metallic value. Limitation of issues, therefore, is essential to a token coinage […] It is by thus keeping a store of legal-tender money and redeeming all token or paper money presented by the public that the modern State assures itself against over-issue.” [pp. 22-23]; “multiple legal tender system.” [p. 24]; [with regard to providing supply to Cromwell in advance on the revenues] “These notes or receipts given by these goldsmiths for money deposited with them were perhaps the first issues of bank-notes in England.” [p. 27]; A bank, therefore, is not an office for borrowing and lending money, but it is a manufacturer of credit […] It is therefore a fundamental error to divide banks into Banks of Deposit and Banks of Issue. All banks are banks of issue. [quoting H. D. Macleod, ‘Theory and Practice of Banking’]” [p. 31]; “notes are accepted because of the reputation of the issuing bank, whilst cheques are accepted entirely on the reputation of the drawer.” [p. 32]; “Thus a deficit in revenue can be filled merely by the printing of more notes, a course which almost inevitably leads to excessive issues.” [p. 35]; “Therefore, as more and more paper is issued, the money of this country will come to contain less and less gold […] prices will rise rapidly” [p. 36]; “In England, since 1844, the privilege of note issue has been practically confined to the Bank of England, subject also to the limitation that all notes issued beyond a certain limit shall be backed by an amount of gold equal to the face value of the notes so issued.” [p. 38]; “Since the American financial crisis of 1907 the regulation of deposits has been universally discredited.” [p. 45]; “I propose to turn to what is perhaps the most interesting and important question of monetary science – the relation between the level of prices and the quantity of money in circulation.” [MV = RP] “This equation is the simplest expression of the “quantity theory” in its modern form, i.e. the theory that, other things being equal, the level of prices (P) will vary with the quantity of money in use (M).” [p. 51]; “[W]e may say indifferently that the course of prices will vary, other things being equal (1) with the total amount of circulating media (deposit and metallic), (2) with the total amount of circulating metal, or (3) with the total amount of circulating metal plus the metal in bankers’ reserves.” [p. 62]; “That is to say, when taking an average, the velocity of each coin must be weighted by its value. In the second place, since velocity of circulation is of importance chiefly as affecting the purchasing power of money, we must take account only of such sums as change hands in payment for goods.” [p. 71]; “[T]he velocity of circulation of coin. This velocity, as has been printed out, is measured by dividing the annual cash expenditure by the average amount of pocket-money.” [p. 73].

Sign up to our newsletter

Sign up for our monthly newsletter to hear the latest news and receive information about upcoming events.