| Entry type: Book | Call Number: 989 | Barcode: 31290035203587 |

-

Author

Robertson, D. H.

-

Publication Date

1928

-

Place of Publication

London

-

Book-plate

No

-

Edition

Revised and reset (first published, January 1922)

-

Number of Pages

181

-

Publication Info

hardcover

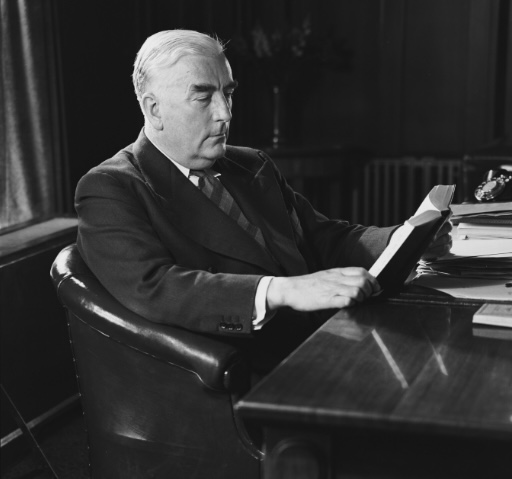

Copy specific notes

Bookplate inserted; written in pencil on front endpaper: “R.G. Menzies”. Numerous highlights made in pencil throughout text including: [p. 3] “It is not necessary that everything which is used as a medium of exchange should itself be also a standard of value, but only that it should be expressed in terms of something which is a standard of value.”; [p. 4] “The first great achievement of money is that it enables man as consumer to generalise his purchasing power, and to make his claims on society in the form which suits him best”; [p. 6] “The advantage of money to the producer. The second great achievement of money is it enables man as producer to concentrate his attention on his own job, and so to add more effectively to the general flow of goods and services which constitutes the real income of society.”; [p. 10] “As it is, the ease with which advances of every kind can be made in money oils the wheels of material progress: but the result is that people tend to confuse the pieces of money, which are mere certificates of a right to draw goods which may not even exist, with the goods themselves, and to lay up all sorts of trouble and disillusionment for themselves. […] The second great drawback about money is closely bound up with the first, and turns on the fact that its value does not, even in ordinary terms, remain perfectly stable, and in times of disturbance is liable to great variation.”; [p. 11] “[we shall not run much risk in accepting the] suggestion of common sense that large and undesigned changes in this value are likely to be disastrous, and that even more moderate variation carries on the face of it certain disadvantages […] Some people sell their services on conditions which can be fixed, by legal contract or by the force of custom, for a long time ahead in terms of money: other people are easily enabled or forced, as the case may be, to bring about alterations in the prices of the services they sell […] Any change therefore, however slight, in the value of money, so long as it is not perfectly foreseen, leads to a certain redistribution of the real income of society between the two groups of persons.”; [p. 13] “but in fact any violent or prolonged exhibition of instability in the value of money affects not only the distribution but also the creation of real wealth: for it threatens to undermine the basis of contract and business expectation on which our economic order is built up.”; [p. 16] “The world deliberately adopts a standard of comfort lower than that which its natural resources and its capital equipment place within its reach, cutting its nose, as it were, to spite its face. And men trained and willing to work find no work to do, and tramp the streets with the parrot cries of journalists about increased output ringing in their ears, and growing rancour in their hearts.”; [p. 17] “By the value of money we mean something analogous to what we mean by the value of anything else, say bread or cloth: that is to say, we mean the amount of things in general which will be given in exchange for a unit of money.”; [p. 18] “The measurement of changes in the value of money has become a matter of considerable practical interest.”; [p. 19] “The problem of course is to build up, out of the figures showing the changes in the prices of particular things, an index-number as it is called, of general prices, which shall show at a glance the change in the value of money.”; [p. 20] “If it [the index number] is to show the changes in the value of money in the most general sense, it must include all the things which are the subjects of exchange in the economic world, including land and houses and securities and so forth.”; [p. 24] “the so-called Ministry of Labour index-number of the cost of living (we shall see in a moment that the popular name for it is not accurate), which has been the basis for the sliding scale of railway wages. If it is said that that number has risen by 65 per cent since July, 1914, what is meant is that the average working class family would have to pay 65 per more now than in July, 1914, for the collection of articles [p. 25] which it is presumed to have been in the habit of consuming in July, 1914. [Have we then obtained a satisfactory measure of changes in general prices? Again, alas! the answer is No. So long as there have not been violent changes between the two dates compared, the measure may be fairly satisfactory, but if there have, it is not.] For people will probably have their consumption of those things which have fallen most, or risen least, in price: and they will probably have cut down their consumption of those things which have fallen least, or risen most in price. […] That figure [the cost of living index number] does not mean that for instance it actually cost the working-class family 150 per cent more to obtain food, clothing, and so forth in June, 1920, than it did in July, 1914, but that it would have cost it 150 per cent more in June, 1920, to obtain the exact collection of things customarily bought in July, 1914 [… p. 26.] One rough way of meeting the difficulty would be to take the percentage price change of the combination consumed at the first date, and the percentage price change of the combination consumed at the second date, and to strike an average between them; and to treat this average as a measure of the change in general prices. And if we use this method to compare the price level each year not directly with some distant year;, but with the year immediately preceding it, we shall get a series of figures which would afford a fairly satisfactory index of the moments of the value of money.”; [p. 27] “It is worth pointing out that an exactly similar difficulty is met in attempting to compare the value of money in different places. For instance, a Board of Trade enquiry into the relative cost of living in England and Germany some years before the war showed that the combination of things ordinarily consumed by an English workman cost about 20 per cent more in Germany than in England, while the combination of things ordinarily consumed by a German workmen only cost about 10 per cent more.”; [p. 28] “We are now in a position to approach the question of the forces by which the value of money is determined”; [p. 29] “Its value therefore is primarily determined by exactly the same two factors as determine the value of any other thing, namely, the conditions of demand for it, and the quantity of it available. […] We can fix our attention on the stock of money in existence at a given point of time, or on the flow of money being used during a given period of time.”; [p. 30] “In any case, an increase in the volume of transactions means an increase in the demand for money. And similarly a decrease in the volume of transactions means a decrease in the demand for money. But given the conditions of demand for money, its value depends on the quantity of it available.; [p. 31] “If one of the available loaves were destroyed, there would be a corresponding loss in real economic welfare [… If one unit of money were suddenly abolished, the possessor of the particular unit selected for abolition would clearly be the poorer. Nobody who has ever lost a sixpence through a crack in the floor will dispute this. But it is by no means obvious that the world as a whole would be impoverished in the same degree: for] the command over real things surrendered by the loser of the sixpence is not abolished, but passes automatically to the rest of the community whose sixpences will now buy more [… But the fact remains that the value of money is (within limits) a measure of the usefulness of any one unit of money to its possessor but not to society as a whole: while the value of bread is also a measure (within limits) of the social usefulness of any one loaf of bread.] And the reason for this peculiarity about money is the fact that nobody generally speaking [p. 32] wants it except for the sake of control which it gives over other things […] given the conditions of demand for money, the relation between its value and the quantity of it available is of this peculiar kind; the larger the number of units available, the smaller, in exactly the same proportion, is the value of each unit […] To use the correct arithmetical term, given the conditions of demand for money, its value varies inversely as the quantity available, or in other words the “general level of prices” caries directly as the quantity of money available.”; [p. 33] “we must take account not only of the total quantity of money, but also of its average “velocity of circulation.”” […] Here is a little story to illustrate this conception of the velocity of circulation of money. On Derby Day two men, Bob and Joe, invested in a barrel of beer, and set off to Epsom with the intention of selling it retail on the racecourse at 6d. a pint, the proceeds to be shared equally between them. On the way Bob, who had one threepenny-bit left in the world, began to feel a great thirst, and drank a pint of the beer, paying Joe 3d. as his share of the market price. A little later Joe yielded to the same desire, and drank a pint of beer, returning the 3d. to Bob. The day was hot, and before long Bob was thirsty again, and so, a little later, was Joe. When they arrived at Epsom, the 3d, was back in Bob’s pocket, [p. 34] and each had discharged in full his debts to the other but the beer was all gone. One single threepenny bit had performed a volume of transactions which would have required many shillings if the beer had been sold to the public in accordance with the original intention […] This “income velocity” of circulation of money is naturally much smaller than its “transaction-velocity.”; [p. 37] “Thus, as the example given above suggests, the demand for money will be greater if people are paid quarterly salaries than if they are paid weekly wages.”; [p. 38, “the peculiarity which we found about money, namely, that] given the conditions of demand for it its value varies inversely as the quantity available”; [p. 42] “Our note then belongs to the order of common money, or money which is universally acceptable within a given political area, and not to the order of bank money, which requires special knowledge, and the making of special arrangements on the part of the recipient.”; [p. 44] “legal tender – that is, money which is certified by law to be valid in final discharge of a debt for any amount from one fellow-citizen to another ; and not to the sub-order subsidiary money, which is only so certified for debts up to a limited small amount, or to the sub-order optional money, which is not so certified at all.”; [p. 45] “we must bravely set down our note as convertible legal tender, of money which one ordinary citizen must accept as final payment from another, but in exchange for which some central institution is bound to give something else if requested; and not as definitive money, or money in which even a central institution is entitled to make a final and ultimate discharge of its obligations.”; [p. 47] “Our note, then, belongs to the race of token money, or money who value is materially greater than the value of the stuff of which it is composed, and not to the race of what we will call full-bodied money, whose value is not materially greater than that of its component stuff.”; [p. 50 “When a cheque for £10 passes from me to my butcher, and is paid in by him to the bank, my deposit at the bank is reduced by £10, and his increased by the same amount: though £10 of money has changed hands, the total volume of deposits at the bank is unaffected.] The relation between the total volume of deposits at any period and the total volume of cheques which passes during that period is thus a particular instance of the relation between the quantity of money in existence and the quantity of money becoming available during a period […] we shall speak then of an individual’s chequery, but of a bank’s deposits. The total of individual chequeries is the same thing as the total of bank deposits.”; [p. 51 “in Great Britain these decisions [regarding loans] are left to the unfettered discretion of the bankers, that is, we may almost say, of those who control the policy of the five giant joint stock banks] – Barclays, Lloyds, the Westminster, the Midland, and the National Provincial. But it is generally believed that the bankers regulate the volume of deposits in accordance with a customary rule of their own, which consists in keeping a certain rough proportion between their deposits and what are called their reserves: and as for the magnitude of this proportion, the figure of 9 to 1 is one which it is now convenient to keep in the head, though it would be wrong to speak as though it were either uniform for all banks or rigidly fixed for any individual bank. These reserves of the banks consist party (at a guess, to the extent of two-thirds) of common money in their own possession, partly of a chequery at the Bank of England.”; [p. 52] “The reserves of the Bank of England consist entirely of common money, namely, its own notes [The chief point of this little extra complexity is that it facilitates the transfer of cheques between people who bank at different banks. If A who banks at bank X pay a cheque for £10 to B who banks at T, and then bank Y, when it gets the cheque from B, will present it for payment to bank X: and bank X will meet its obligation by drawing a cheque for £10 on its chequery at the Bank of England.] As a matter of fact the stream of transactions of this nature between the big banks is large and steady in all direction that the banks are enabled to cancel most of them out by means of an institution called clearing-house: but the existence of these chequeries at the Bank of England facilitates the payment of any balance which it may not be possible at the moment to deal with in this way. [A thorough understanding of this process is important, for it will enable us to simplify several subsequent arguments by speaking as though there were only one bank in existence, leaving the reader to introduce for himself the] complications required by the existence of several banks squaring up with one another by means of their chequries at the Bank of England.”; [p, 53] “If we enquire why the volume of deposits should bear any reference to the volume of common money, the answer is not far to seek. It lies in the familiar fact that bank money is convertible […] A bank therefore which gives the right to draw cheques must be able to lay its hands on enough common money to cash such proportion of those cheques as will in fact be presented for conversion. It is not surprising therefore that the banks should regulate their deposits with some reference to the amount of common money in their possession, or within their immediate reach.”; [p. 54] “For the common money which is paid out in exchange for cheques does not continue for ever in circulation : it finds its way back to the banks from the traders and shopkeepers to whom it is handed in payment for goods”; [p. 55] “The practice of bankers is a compromise between keeping the pool which they expect in fact to be large enough, and keeping the only pool which could possibly in all circumstances be large enough […] People sometimes tend to speak as though there was some mystic figure of proportion of reserves to deposits – whether the English 1 to 9 or some other – without attaining which no banking system can become respectable, and on attaining which any banking system becomes unassailable.”; [p. 56] In continental countries the regulation of the volume of bank money, which has not hitherto been of very great importance, is left as in England to the discretion of the banks: but in the United States, where the predominance of bank money of the money-system is as pronounced as in England, the law has stepped in. Those banks (controlling about two-thirds of the banking resources of the country) which are member of the national banking system are obliged to keep a minimum proportion of reserves which works out at about 10 per cent on the average of “demand” deposits, against which cheques can be drawn without notice, and at 3 per cent of “time” deposits, against which cheques can nominally only be drawn if a month’s notice has been given. The twelve Federal Reserve Banks, which play in American something of the same role as the Bank of England plays in England, are obliged to keep, not indeed in common money but in coined or uncoined gold, a reserve amounting to at least 35 per cent of their deposits.”; [p. 57 “Certainly the American law does its best to guard against untrue rigidity.] For in the first place the ordinary banks are obliged to keep the whole of the legal reserves in the form of chequeries with the Reserve Banks.”; [p. 59] “The relation between bank money and common money therefore depends only in part on the more or less arbitrary and conventional decisions of bankers regarding their reserves: it depends also partly on something more fundamental though not alterable – the business habits and preferences of the community.”; [p. 60] “the proportion which convertible legal tender bears to definitive money is influenced by the habits of the people.”; [p. 61, “Sometimes the law sets a limit to the total issue of some kind of convertible legal tender, as was the case with the notes of the Bank of France before the war, and is still the case with one of the many kinds of American common money, the so-called “Greenbacks” or United States notes. More usually it] lays down rules about the reserves which must be kept by Governments and banks against the convertible common money which they permit to circulate. […] The English practice, dating from the celebrated Bank Act of 1844, has been to limit the “uncovered” or “fiduciary” issue of convertible common money [- the excess, that is, of the total issue over the amount held of the stuff prescribed as reserve. Thus until 1928 the fiduciary issue of the Bank of England was limited by law to an amount which in that year has reached about £20 million; and from 1919 to 1928 the fiduciary issue of the Bank of England was limited by law to an amount which in that year had reached about £20 million; and from 1919 to 1928 the fiduciary issue of the Treasury Notes issued since 1914 by the Government was limited, no indeed by law but by the Treasury ordinance, on the same lines.] In 1928 provision was made for amalgamating the two issues in the hands of the Bank of England, and the latter’s fiduciary issue fixed afresh at £260 million. Elsewhere than in England the alternative method of regulation, which consists in prescribing the minimum proportion of reserves to convertible common money outstanding, is almost universal. [Thus in America against two kinds of convertible legal tender (gold and silver certificate) a reserve of 100 per cent must be kept, [p. 62] against two kinds of token optional money (National Bank notes and Federal Reserve Bank notes) a reserve of 5 per cent, and against the remaining and most important kind] (Federal Reserve notes) a reserve of 40 per cent. In European countries, where the note-issue is for the most part now concentrated in the hands of central banks, similar provisions prevail. Thus the Reichsbank has to keep a reserve of 40 per cent against its issues of notes, the Bank of France a reserve of 35 per cent, and the Russian State Bank a reserve of 25 per cent.; [p. 64 – page also earmarked] “In this book, then, the phrase “a gold standard” will be used to denote a state of affairs in which a country keeps the value of its monetary unit and the value of a defined weight of gold at an equality with one another. […] a policy of keeping this value at an equality with that of a defined weight of gold involves the regulation of the supply of money.”; [p. 65, “But provided the rules and practices about reserves which we examined in the last chapter are pretty rigidly adhered to by the several parties concerned, that are various devices available for diminishing the element of conscious initiative, and increasing the element of automatic response, in the action of the central authority.] The most obvious of these devices is for the central authority to be put under obligation to be always prepared, on the one hand, to convert at least some one important kind of convertible money into uncoined gold at a fixed rate, and on the other hand to buy uncoined gold for money at a fixed rate […] the Bank of England is obliged to buy standard gold at the rate of £3 17s 9d. an ounce, and to sell gold bars, of a minimum weight of about 440 ounces, in exchange for its notes at a price of £3 17s 10 1/2d an ounce. This arrangement is known as the gold bullion system.”; [p. 66] “In the light of our idea of a standard, however, we see that this “gold circulation system,” as we may call it, is simply one device among others for facilitating the maintenance of a gold standard.”; [p. 67] “In France from 1803 to 1870 there were two kinds of full-bodied definitive money, one made of silver and one of gold, and both these metals were freely accepted at the mints for coinage into money.”; [p. 68] “France had throughout the period a bimettalic system, but she had first a silver and then a gold standard.”; [p. 69] “This arrangement was generally described as a “limping standard” – the idea being that the standard had as it were two legs, one of gold and one of silver, but that the silver leg was crippled and deformed.”; [p. 70] “now we can turn to our main question – what determines the rate of exchange between pounds and utopes.?”; [p. 71] “It has become customary to assert that the normal level of the rate exchange depends on the relative price-levels, in the moneys of the two countries, of the things which enter into trade between them […] It is usual to add that the rate of exchange may at any time diverge from its normal level within limits depending on the amount of the transport charges and duties (if any) on the goods most likely to be transported between the two countries.”; [p. 72] “The proposition under debate, therefore – that the rate of exchange between two countries with arbitrary standards depends on the relative purchasing power of [p. 73] the money of the two countries over those good which are the subject of trade between them […] Let us next suppose that England and Utopia are each maintaining a gold standard, through the operation of a gold circulation or gold bullion system […] the normal rate of exchange depends on the relative values of the two monies in terms of god, that is, on the relative [p. 74] weights of gold defined in the law of the two countries as the bases of their respective standard. And the refining further, we can say that the actual rate of exchange cannot diverge from this normal level in either direction by an amount which exceeds the cost of sending gold from one country to another […] historically indeed, it is this relative fixity of the exchanges under a gold standard which has furnished the main incentive to numerous countries to establish or to restore one.”; [p. 75 “suppose that Utopia decides to establish a gold standard and wishes from some kind of artificial stiffer – a kind of corset or Dr Scholl’s metatarsal arch support – to strengthen her resolution and lighten her intellectual task in maintaining it.] It may perhaps occur to her that since English money is being kept stable in terms of gold, she will have succeeded in [p. 76] maintaining a gold standard if she can keep stable her rate of exchange with England: and that the latter result will be ensured if her monetary authority is always prepared to sell claims to English money to Utopians, and to buy claims to English money from them, at a fixed rate. But of course in order to be sure of doing this, the Utopian monetary authority will have to keep a stock of claims to English money; and it is quite natural therefore that in the Utopian reserve regulations chequeries with English banks, and English securities which can readily be sold in exchange for such chequeries, should play the same leading part that is played in the English reserve regulations by coined or uncoined gold. This system, which is known as the gold exchange system was invented before the war independently by certain European countries such as Austria which wished to economise in the use of gold, and by the Government of India.”; [p. 77] “The gold exchange system has been widely adopted in the monetary legislation of countries with a dependent political status] but since the war it has also been adopted in its essential by a number of countries – such as Russia, Germany, and Italy – whose sovereign status nobody would question, but which desired to re-establishing a gold standard without indulging in the luxury of keeping a big stock of gold.”; [p. 79] “It looks therefore as if we could confidently take a step forward, and say that in such a country [one adopting the gold standard] the quantity of money depends on the world value of gold.”; [p. 84] “Bearing all this in mind we may fairly say that in a gold-standard country the quantity of money will be ultimately limited, if by nothing else, then by the cost of production of gold, and that in any case its value tends to equal the marginal cost of production of a given weight of gold.”.

Related entries

Sign up to our newsletter

Sign up for our monthly newsletter to hear the latest news and receive information about upcoming events.